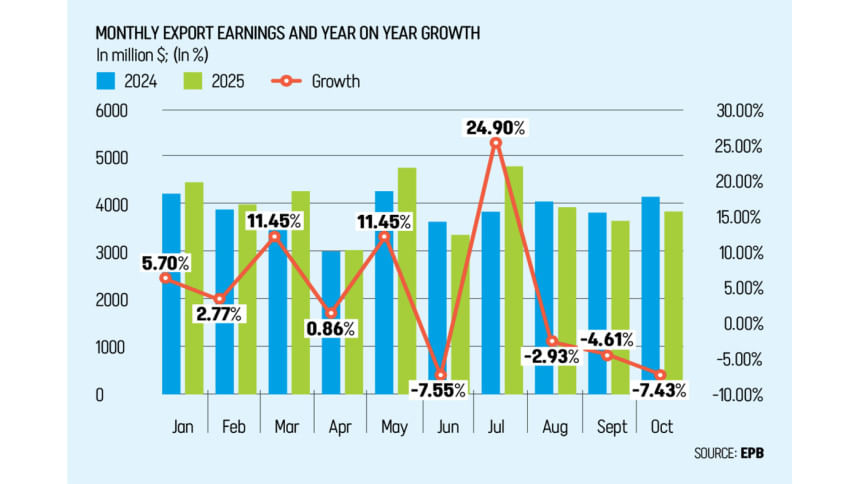

The country's merchandise shipments declined for a third month in a row in October, dropping 7.43 percent year-on-year to $3.82 billion, according to official data.

The slowdown comes as global economic headwinds and uncertainty over United States trade policy weigh on the country's crucial garment sector.

The fall in October followed a 4.61 percent drop in September and a 2.93 percent decline in August owing to a continued fall in the shipments of both knitwear and woven garments to Western markets, according to the Export Promotion Bureau (EPB).

In October, garment exports fell 8.39 percent year-on-year to $3.01 billion, the sharpest drop seen so far in the first four months of this fiscal year. In September, the decline stood at 5.66 percent.

Exports of frozen and live fish, shrimp, agricultural and processed goods, pharmaceuticals, headgear and plastic products also fell in October compared to the same month last year.

Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), a private research organization, said the downturn reflected both external and domestic pressures.

He pointed to a tougher global trading environment, coupled with uncertainty over US trade decisions.

The economist said reciprocal tariffs imposed by the US administration had added uncertainty to global value chains. At the same time, higher interest rates and inflation in key markets such as the European Union had slowed retail demand, meaning fewer import orders.

In August, the US imposed additional tariffs on dozens of countries under President Donald Trump's reciprocal tariff policy. Bangladesh has faced an additional 20 percent tariff on exports to the US market, which accounts for around one-fifth of its total earnings.

Razzaque said these developments were weighing on export-oriented industries, particularly garments, which rely heavily on discretionary consumer spending in advanced economies.

In October, knitwear, Bangladesh's main export item, declined by 11 percent year-on-year, while woven garment shipments fell by 5 percent, according to the EPB.

Domestic factors have also added pressure. Razzaque said rising production costs, higher prices of raw materials, and persistent inflation were eroding competitiveness.

He said the continued slowdown over three months reflected weaker global demand and shrinking price advantages, suggesting external challenges were likely to continue in the short term.

Some sectors, however, bucked the trend. Leather goods, footwear and engineering products reported growth in October, helping to keep overall exports positive since July.

In the July-October period, total exports rose 2.22 percent year-on-year to $16.13 billion, according to EPB. Garment shipments grew 1.4 percent during the first four months of the fiscal year.

Faisal Samad, director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said demand for apparel slowed as US retailers and brands built up stocks between April and August to avoid higher tariff rates.

He said domestic issues, including gas supply shortages in factories, high bank interest rates and the recent fire at Dhaka airport, had affected the shipments.

Global demand for clothing has softened further as retailers and brands wait to see how US tariffs on China and India unfold, Samad said.

"There is total uncertainty over tariff rates. Work orders are stuck. Buyers are making inquiries about work orders but not confirming them yet because they do not know what tariff the US will finally set," he told The Daily Star.

He said larger factories are still processing earlier orders, but smaller and medium-sized units are facing a shortage of new work.

During the July-October period, frozen and live fish exports rose 12 percent to $171 million. Leather and leather goods increased 11 percent to $413 million. Jute and jute goods shipments continued to recover, rising 5 percent to $277 million. Home textiles and headgear also posted growth.

Agricultural exports fell 2 percent to $378.85 million in the same period. Plastic exports dropped 4 percent to $98.35 million, while cotton and cotton yarn declined 10 percent to $190.05 million.

"We are observing a downward trend across most segments in the plastic industry, except for plastic bags, which show some positive growth," said Shamim Ahmed, president of the Bangladesh Plastic Goods Manufacturers and Exporters Association.

"When global demand drops, it directly affects our export orders. On top of that, we are struggling to stay competitive due to higher interest rates at home," he said.

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said garment exports may fall again over the next two or three months as orders from foreign buyers remain slow.

"The gas supply situation in industrial units needs to be improved in the meantime," he said.