Bangladesh Bank has not published the banking sector's classified loan data for the April-June quarter even five months after it ended, leaving analysts without a clear picture of the sector's condition.

The central bank usually releases non-performing loan (NPL) figures within a month of each quarter's end. This year, however, publication has been consistently delayed. The January-March data came out only in June, and no date has been set for the second-quarter release even though banks have already begun publishing their third quarter figures.

The lack of updated information has added to uncertainty among stakeholders assessing the scale of loan stress in the sector. BB has not offered a clear explanation for the delay.

When asked, Arefin Hossain Khan, executive director and spokesperson of the central bank, told The Daily Star last week that the figures were pending because Governor Ahsan H Mansur had been abroad. "But he has now returned, and it is expected that the data will be published soon," he said.

According to central bank officials, the regulator collects quarterly data from commercial banks and typically needs about a month to compile the dataset. After preparation, it is forwarded to various departments following the governor's approval.

"Based on the classified loan data, multiple reports are produced, helping stakeholders understand the banking industry," one official said.

DELAY COMES AMID RISING NPLs

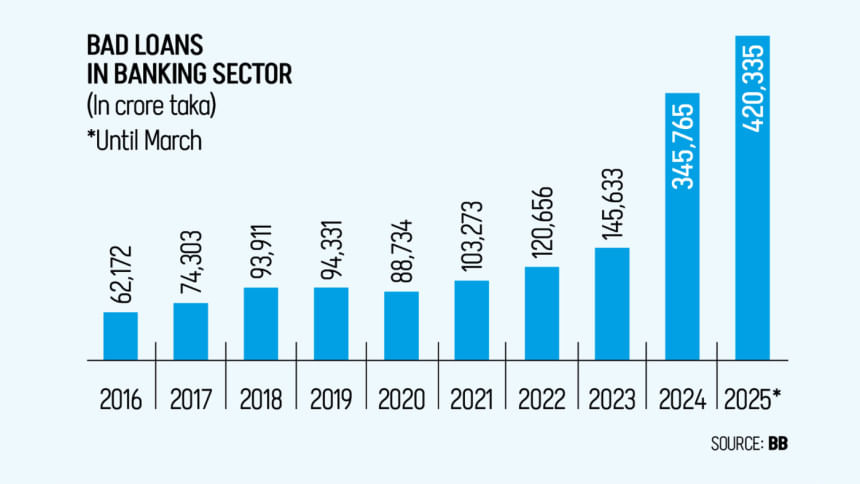

The delay comes at a time when non-performing loans have been hitting record highs. In March, NPLs reached a record Tk 4,20,335 crore -- 24.13 percent of total outstanding loans of Tk 17.42 lakh crore -- according to BB data. At the end of 2024, bad loans stood at Tk 3,45,765 crore, meaning Tk 74,570 crore was added in just three months.

Years of loan irregularities, scams and mismanagement during the previous Awami League government pushed NPLs to these levels, according to officials. After the political changeover in 2024, the hidden loans started to come to light.

Unofficial estimates suggest bad loans may have exceeded Tk 6 lakh crore by June, with several banks now reporting that more than half their loan books are in default.

BB has asked banks to intensify recovery and rescheduling efforts to contain the surge.

Governor Mansur has publicly stated on multiple occasions that actual bad loans exceed 30 percent of the banking sector's loan stock.

Multiple banks have reported steep rises in defaults. AB Bank's NPLs, for instance, have climbed to nearly 84 percent of its total loans. As of September, the bank had Tk 35,982 crore in outstanding loans, of which Tk 30,138 crore were classified as bad. The bank had Tk 10,115 crore in bad loans in September 2024. Union Bank alone accounted for Tk 25,303 crore of the country's Tk 4,20,335 crore in bad loans as of March 2024.

'WHY THE SECRECY?'

Analysts say the delay undermines transparency at a moment when confidence in the banking sector is fragile.

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development and a former BB chief economist, said withholding information is a trait of the ousted government.

"This should not be the case under the current government. People must be allowed to know the real facts," he said.

He questioned why BB, which introduced the practice of publishing NPL data quarterly, is now holding it back. When information is not published in a timely manner, it creates confusion among stakeholders and leads to misconceptions.

"Everyone knows NPLs have increased significantly, so why this secrecy? We have heard they have now reached Tk 6.5 lakh crore. Whatever the actual figure is, it should be disclosed. Without timely data, it is not possible to formulate the right policies," he stated.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, echoed the concern. "Getting data on time has long been a challenge in Bangladesh," she said. "We need classified loan information for proper analysis. If data is delayed, it loses relevance."